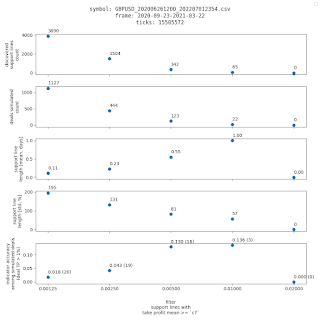

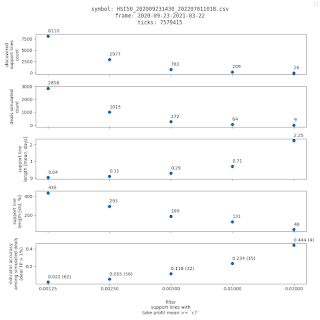

Backtest support line bounce based indicator accuracy

Idea behind expert advisor and experimenting with dataset

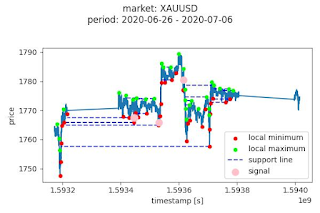

Support line indicator is based on repetitive extremum points. If say few times in a row price has dropped at some value and then got up. That value is defined as support line. It's likely that it comes close to support line again the pattern will repeat. We are to place an order when this occurs. Stop loss equals support line value. Take profit equals +1% of the entry price. To avoid amount of false positives, we are to use some extra margin like 0.1% during comparisons. So that if price fluctuates around support line +-0.1% we are to wait, until it is either <-0.1% or >0.1% to take the action. If the value drops below support line, indicator didn't work in this case. Otherwise, we are placing an order. To further reduce false positives few times is defined as 3 times, or any other positive number. It can be adjusted later on based on backtest results. But it's not good to optimize all of the indicator constants to avoid over fitting.

Let's backtest the strategy on 10 markets for the last 2 years. We are to estimate amount of correct predictions, incorrect ones, as well as final profit considering each trade is being executed in a all in manner.

market order_type acc all_in_balance total_trades start end 0 XAUUSD buy 19.14 % 15.775 % 653 2020-06-26 2022-06-24 1 EURUSD buy 14.34 % -7.973 % 258 2020-06-26 2022-07-01 2 GBPUSD buy 19.76 % 14.677 % 420 2020-06-26 2022-07-01 3 USDCAD buy 15.93 % -3.975 % 339 2020-06-26 2022-07-01 4 USDJPY buy 16.23 % -2.046 % 228 2020-06-26 2022-07-01 5 FCHI40 buy 16.30 % -7.112 % 454 2020-09-23 2022-07-01 6 GDAXIm buy 14.24 % -15.743 % 316 2020-09-23 2022-07-01 7 HSI50 buy 14.45 % -10.783 % 339 2020-09-23 2022-07-01 8 NI225 buy 18.81 % 7.834 % 404 2020-09-23 2022-07-01 9 SP500m buy 18.45 % 6.378 % 412 2020-09-23 2022-07-01

|

| Fig 1. Good example, XAUUSD market |

|

| Fig 2. Good example, EURUSD market |

|

| Fig 3. Good example, FCHI40 market |

|

| Fig 4. Good example, HSI50 market |

|

| Fig 5. Bad example, USDCAD market, indicator is not profitable here |

|

| Fig 6. Bad example, need constants readjustment, lots of false positives |

Let's apply another regularization. We are to limit support line extremum points. They are to be apart no more than +-50% from the mean distance among them.

market order_type acc all_in_balance total_trades start end 0 XAUUSD buy 21.36 % -9.852 % 337 2020-06-26 2022-06-24 1 EURUSD buy 24.09 % 1.245 % 137 2020-06-26 2022-07-01 2 GBPUSD buy 24.08 % 1.964 % 191 2020-06-26 2022-07-01 3 USDCAD buy 18.45 % -10.221 % 168 2020-06-26 2022-07-01 4 USDJPY buy 29.77 % 11.619 % 131 2020-06-26 2022-07-01 5 FCHI40 buy 24.19 % 0.795 % 186 2020-09-23 2022-07-01 6 GDAXIm buy 24.66 % 2.217 % 146 2020-09-23 2022-07-01 7 HSI50 buy 22.52 % -2.928 % 151 2020-09-23 2022-07-01 8 NI225 buy 25.15 % 3.014 % 163 2020-09-23 2022-07-01 9 SP500m buy 19.41 % -8.652 % 170 2020-09-23 2022-07-01

market order_type acc all_in_balance total_trades start end 0 XAUUSD sell 19.72 % -13.666 % 284 2020-06-26 2022-06-24 1 EURUSD sell 25.17 % 3.820 % 143 2020-06-26 2022-07-01 2 GBPUSD sell 23.50 % 0.839 % 200 2020-06-26 2022-07-01 3 USDCAD sell 26.83 % 8.297 % 164 2020-06-26 2022-07-01 4 USDJPY sell 19.70 % -5.844 % 132 2020-06-26 2022-07-01 5 FCHI40 sell 18.90 % -9.813 % 164 2020-09-23 2022-07-01 6 GDAXIm sell 20.83 % -6.834 % 144 2020-09-23 2022-07-01 7 HSI50 sell 26.00 % 3.852 % 150 2020-09-23 2022-07-01 8 NI225 sell 22.62 % -1.135 % 168 2020-09-23 2022-07-01 9 SP500m sell 25.14 % 4.588 % 175 2020-09-23 2022-07-01

Past bounces should have take profit not less than 1%. This optimization should exhibit ~50% accuracy for the indicator. Cause chances to hit below or higher than mean are 50/50 for a gaussian distribution. Backtest results do not support the hypothesis though.

market order_type acc all_in_balance total_trades start end 0 XAUUSD buy 24.00 % -0.144 % 25 2020-06-26 2022-06-24 1 EURUSD buy 40.00 % 1.078 % 5 2020-06-26 2022-07-01 2 GBPUSD buy 0.00 % -0.611 % 2 2020-06-26 2022-07-01 3 USDCAD buy 12.50 % -1.072 % 8 2020-06-26 2022-07-01 4 USDJPY buy 40.00 % 1.063 % 5 2020-06-26 2022-07-01 5 FCHI40 buy 22.22 % -0.509 % 27 2020-09-23 2022-07-01 6 GDAXIm buy 31.25 % 1.074 % 16 2020-09-23 2022-07-01 7 HSI50 buy 25.00 % 0.634 % 16 2020-09-23 2022-07-01 8 NI225 buy 36.00 % 4.112 % 25 2020-09-23 2022-07-01 9 SP500m buy 12.50 % -2.281 % 16 2020-09-23 2022-07-01

market order_type acc all_in_balance total_trades start end 0 XAUUSD sell 36.84 % 2.771 % 19 2020-06-26 2022-06-24 1 EURUSD sell 28.57 % 0.495 % 7 2020-06-26 2022-07-01 2 GBPUSD sell 11.11 % -1.406 % 9 2020-06-26 2022-07-01 3 USDCAD sell 0.00 % -0.308 % 1 2020-06-26 2022-07-01 4 USDJPY sell 0.00 % -0.605 % 2 2020-06-26 2022-07-01 5 FCHI40 sell 13.04 % -3.301 % 23 2020-09-23 2022-07-01 6 GDAXIm sell 24.14 % -0.075 % 29 2020-09-23 2022-07-01 7 HSI50 sell 30.77 % 1.463 % 13 2020-09-23 2022-07-01 8 NI225 sell 21.43 % -0.628 % 28 2020-09-23 2022-07-01 9 SP500m sell 27.27 % 1.006 % 22 2020-09-23 2022-07-01

New discoveries behind the algorithm. Unexpected results after the alterations.

|

|

|

|

|

|

|

|

|

|

||

|

Fig 6. XAUUSD, EURUSD, SP500, GBPUSD, USDCAD, USDJPY, FCHI40, GDAXIm, HSI50, NI225; ~6months |

||

market accuracy positive samples 0 XAUUSD 9.8% 37 1 EURUSD 7.9% 5 2 GBPUSD 13% 16 3 USDCAD 11% 8 4 USDJPY 7.5% 3 5 FCHI40 9.6% 45 6 GDAXIm 11.9% 41 7 HSI50 11.8% 32 8 NI225 11.1% 43 9 SP500m 10.3% 46Accuracy stats are

accuracy count 10.000000 mean 0.103900 std 0.017477 min 0.075000 25% 0.096500 50% 0.106500 75% 0.116250 max 0.130000

Comments

Post a Comment